Fixed Assets System

AlAmeen program helps users in processing and managing fixed assets by defining them, entering their values, estimating their productive life, calculating depreciation, and tracking changes in their values while providing comprehensive reports.

Fixed Assets Management:

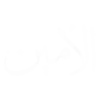

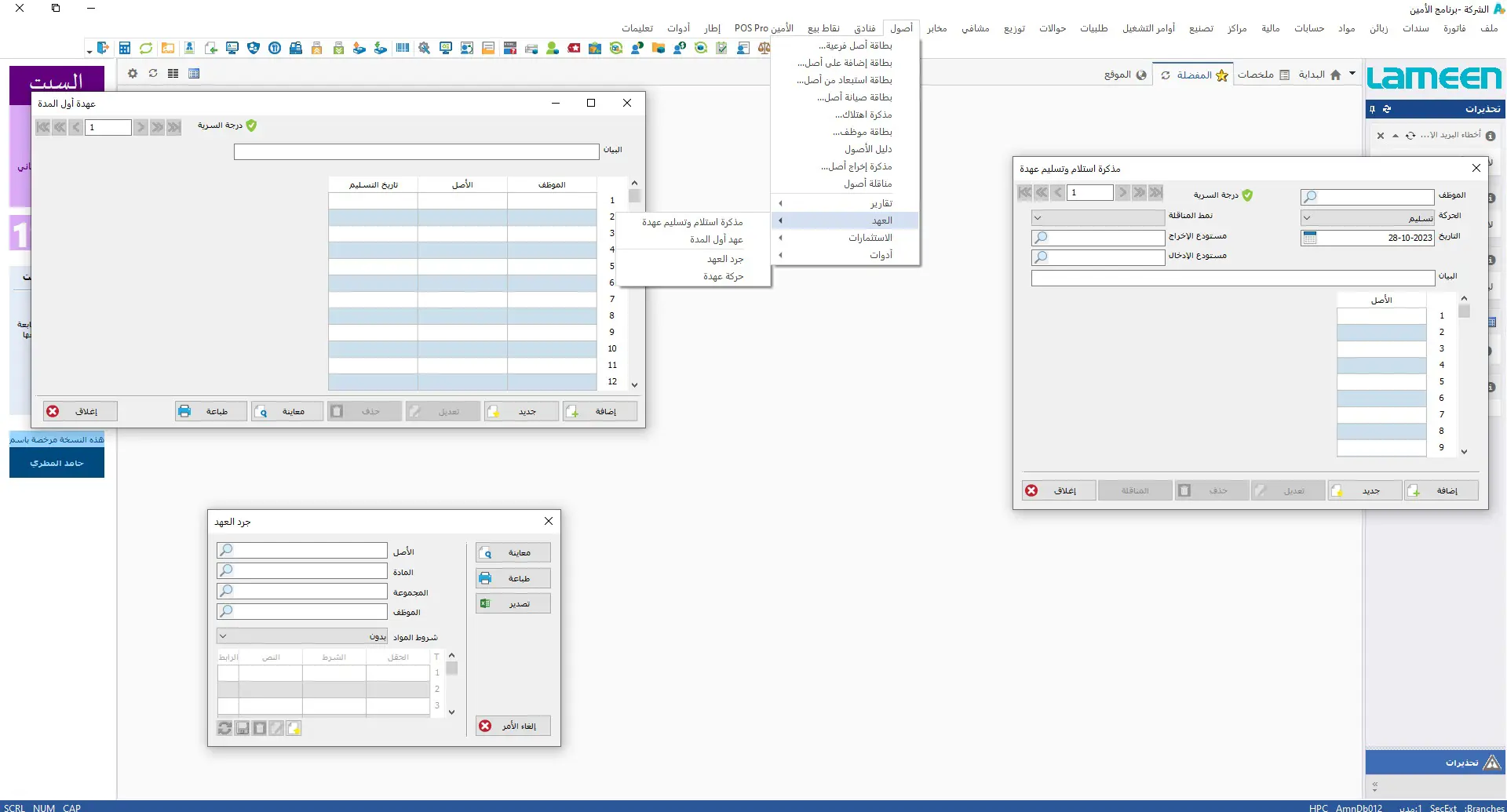

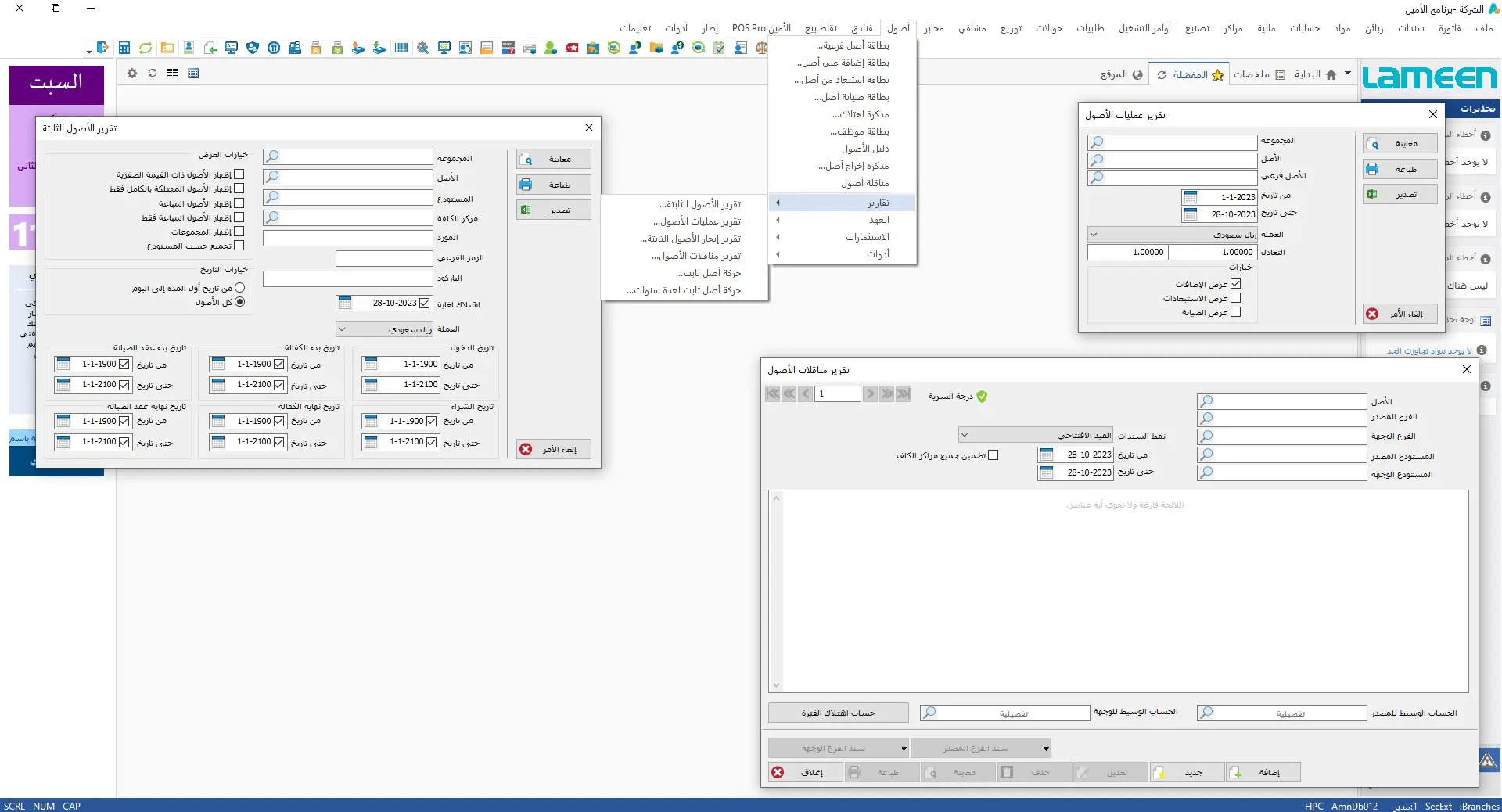

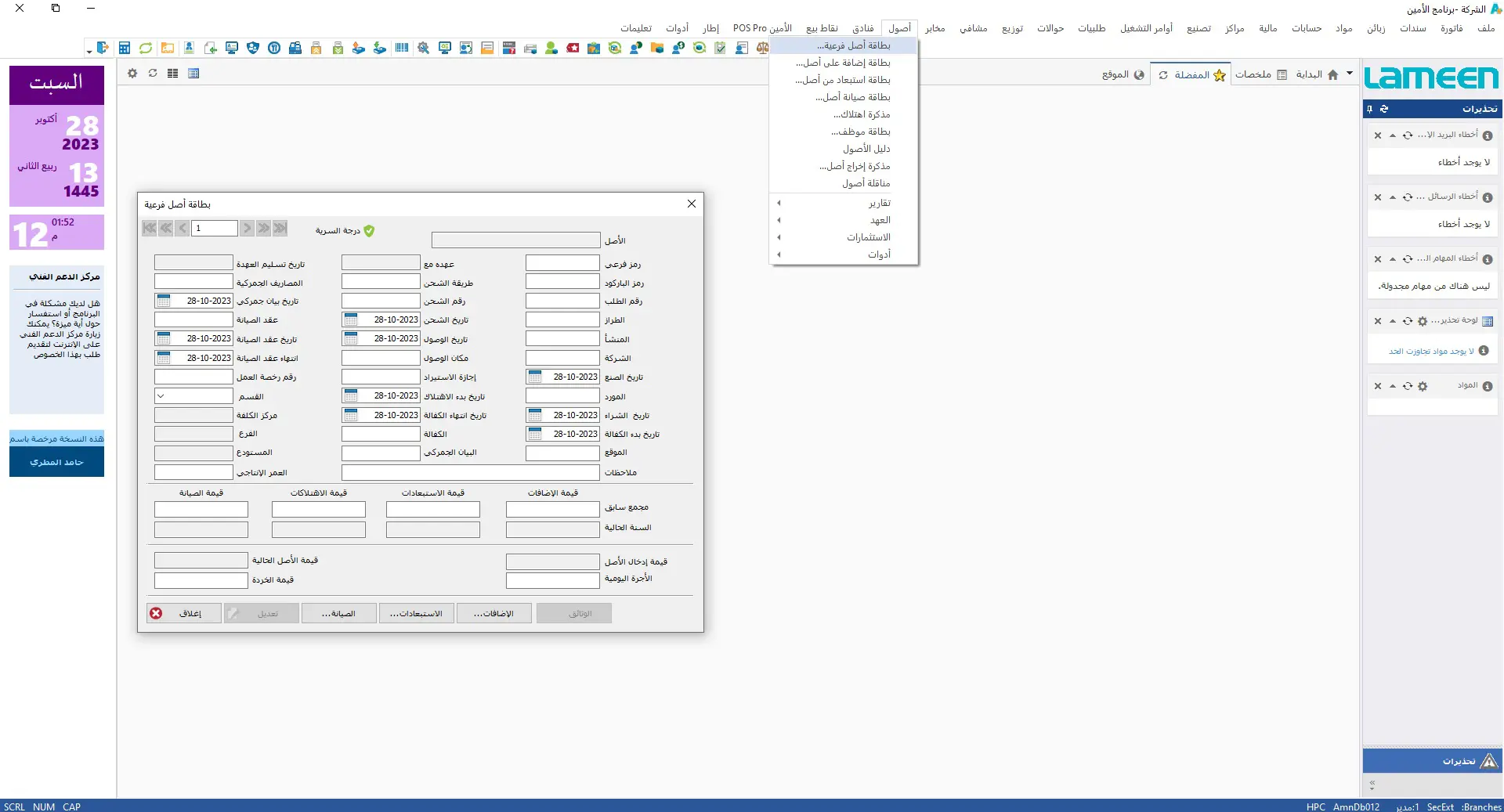

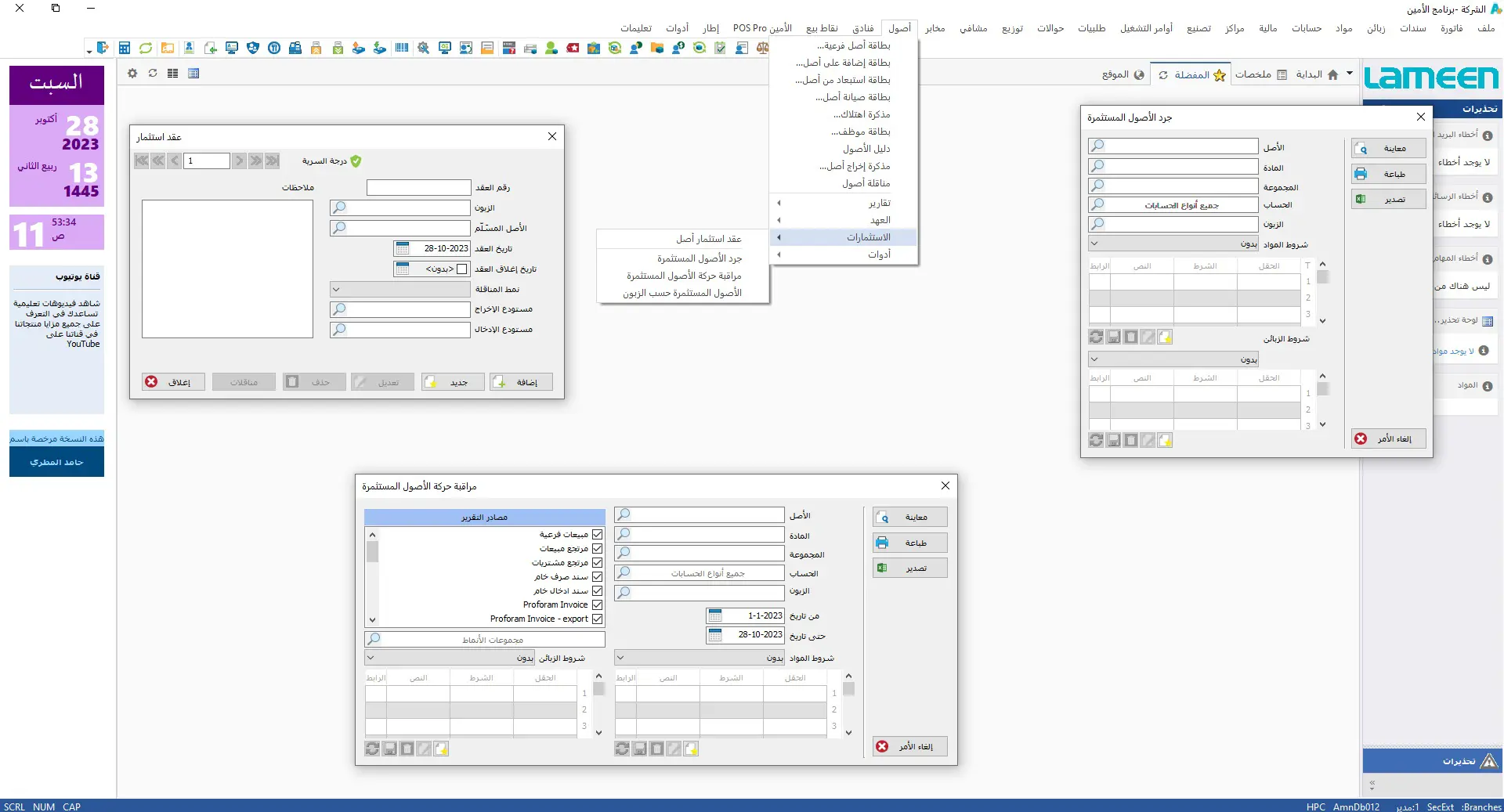

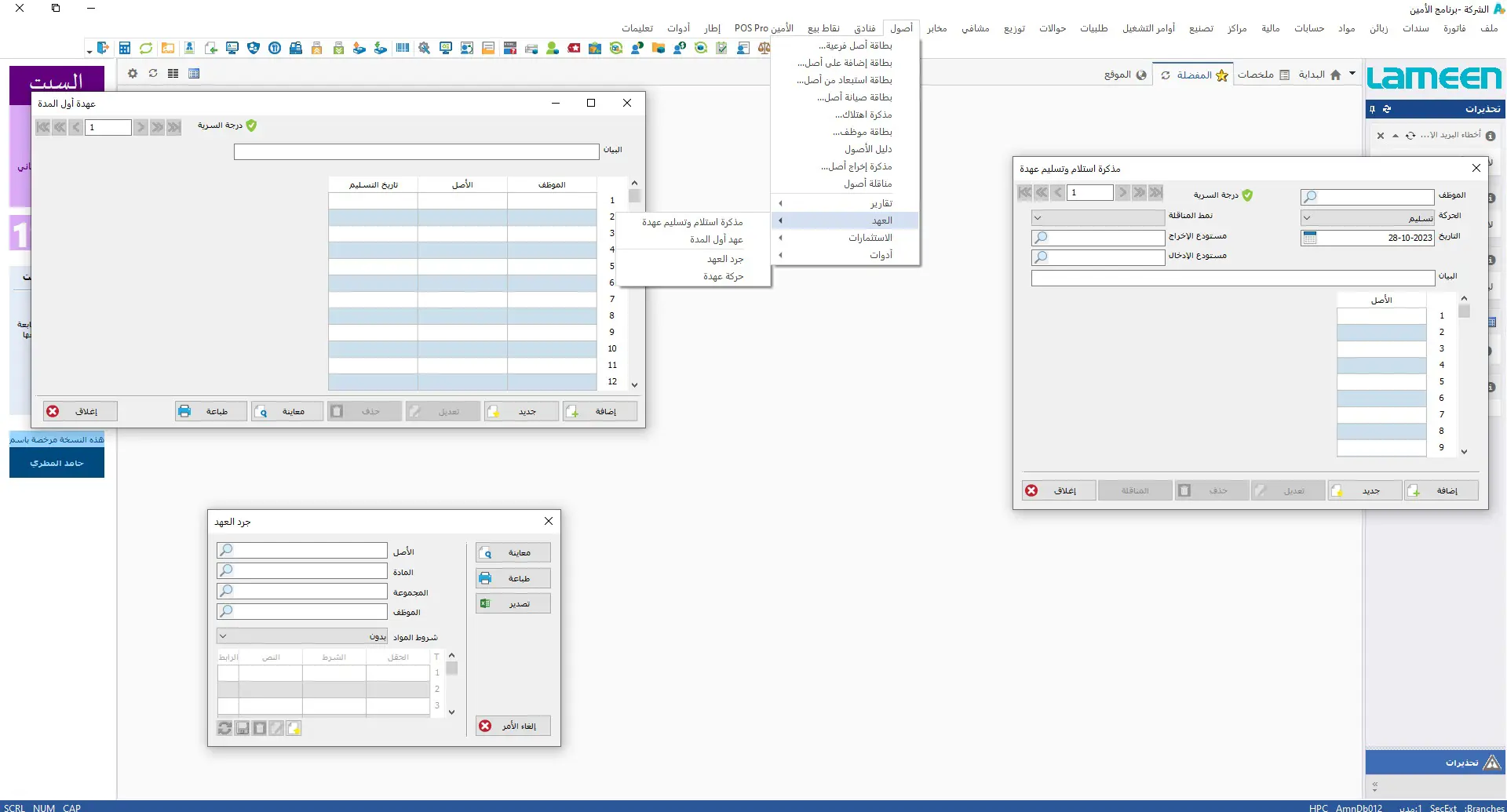

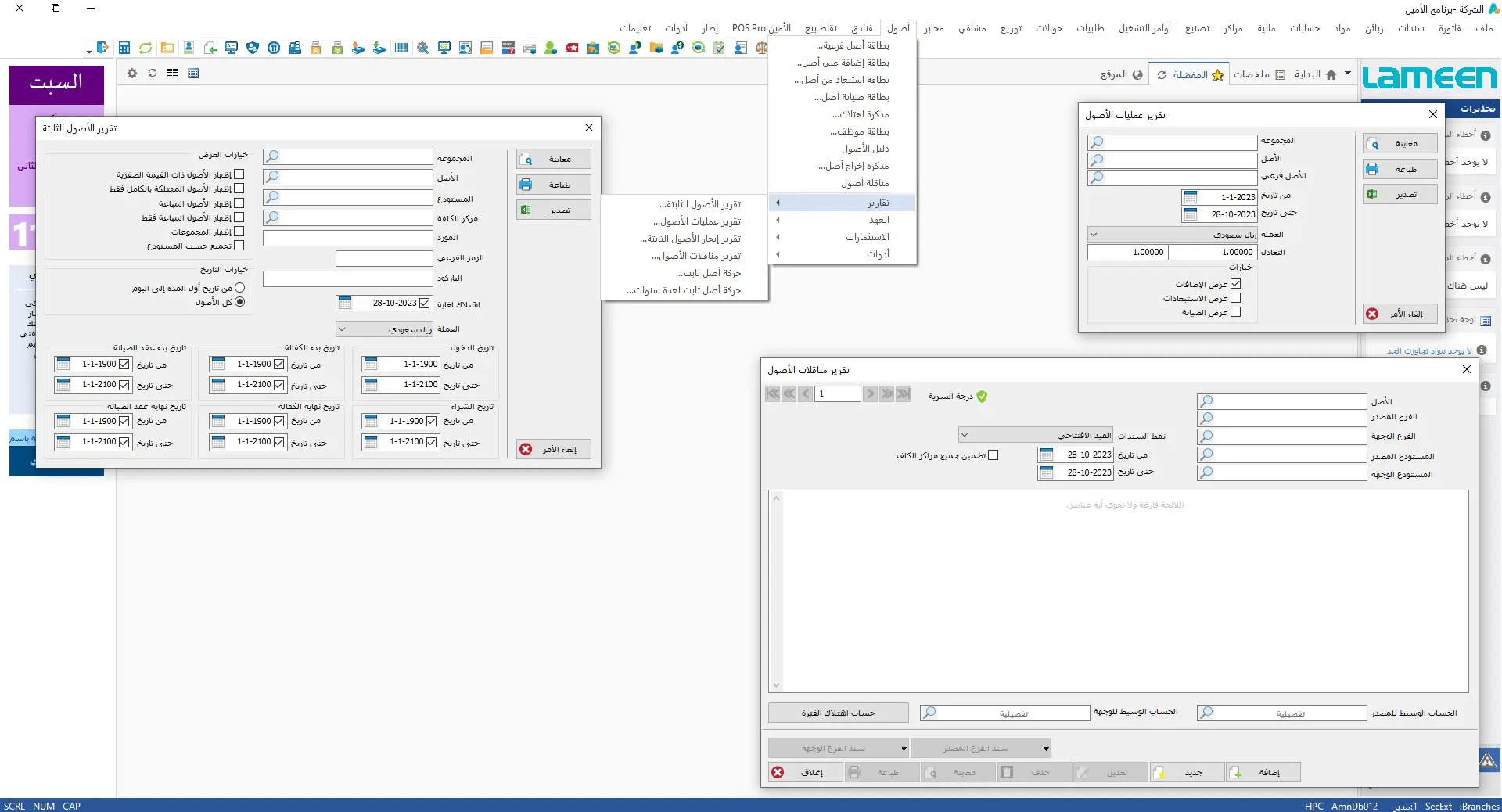

All these processes are accompanied by effective reports and tools to ensure full control over all your assets. Assets are processed in terms of identification, consumption, and operations performed on the asset through the fixed asset card, sub-asset card, and operation card. This includes additional asset cards, exclusion from asset cards, asset maintenance cards, depreciation notes, and asset disposal notes. The program also includes various reports related to assets such as asset operations reports, fixed assets reports, and depreciation percentages

for total collections by branch.

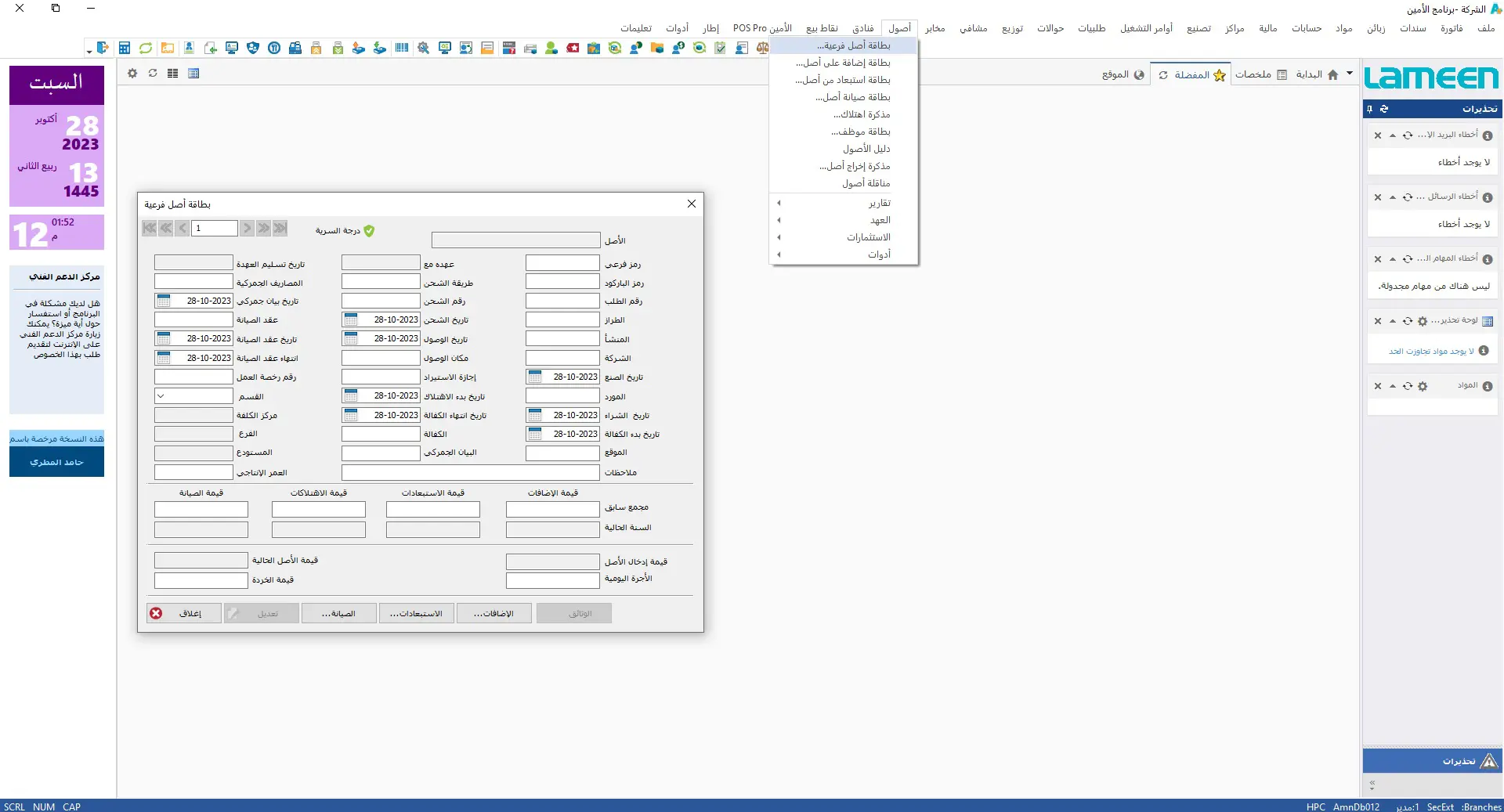

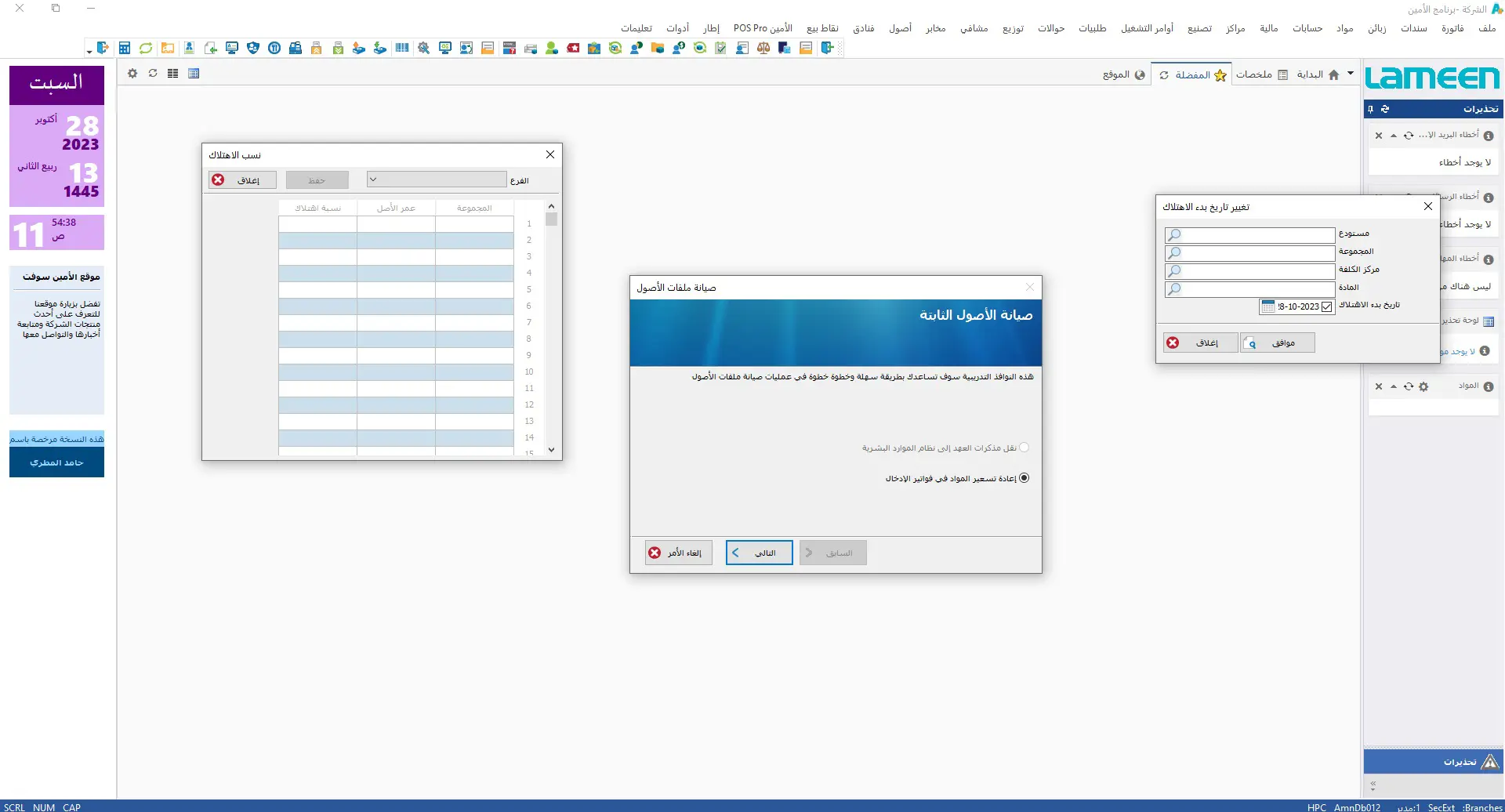

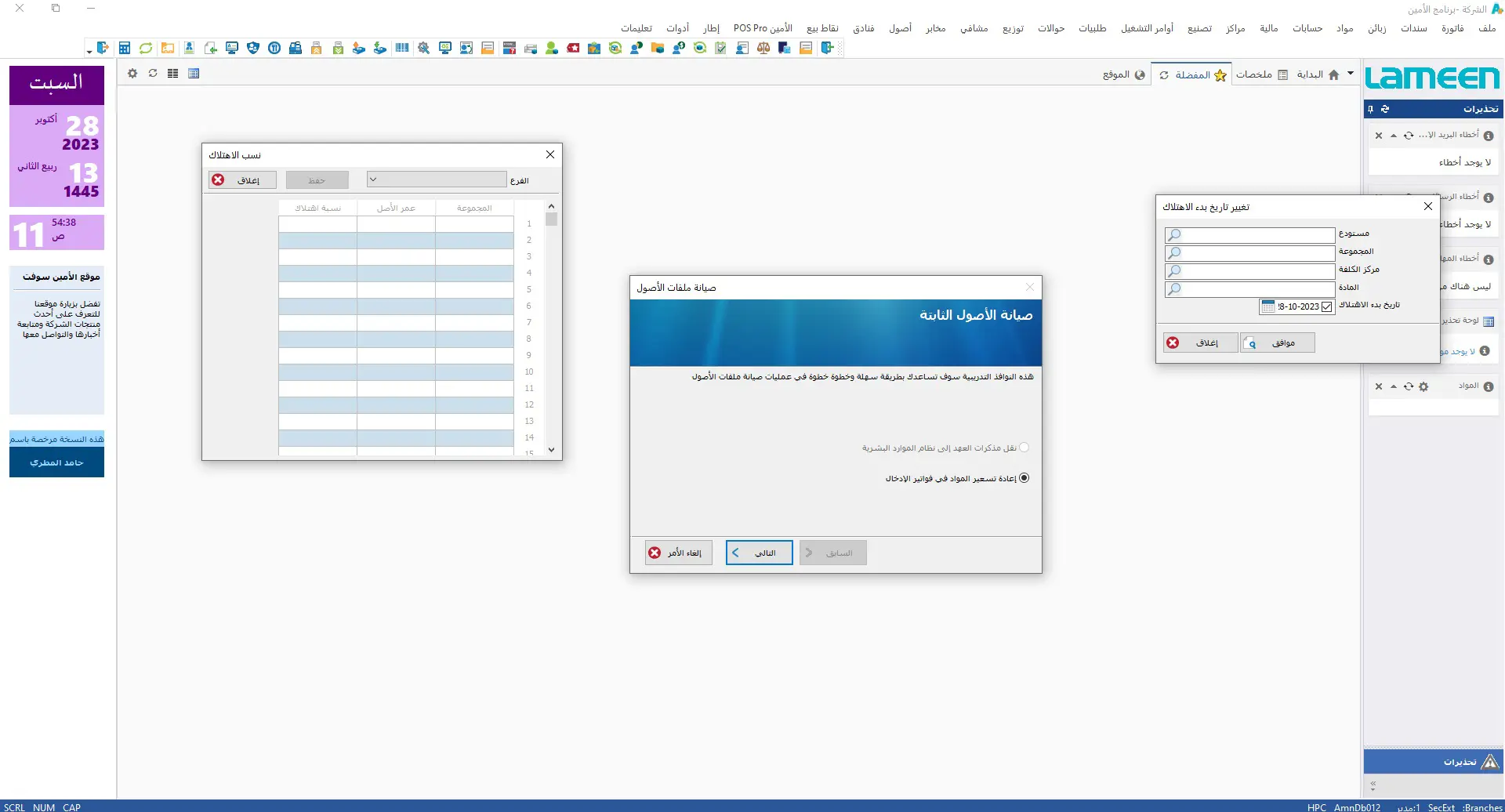

The program also provides maintenance operations for the asset system, the ability to invest an asset in exchange for a certain quantity of sales, and the ability to link the asset to a specific customer investment contract, tracking sales for the customer according to the mentioned agreement. Additionally, tracking depreciation of fixed assets that are no longer difficult is made possible by generating automatic depreciation for assets with book value not equal to zero

while considering the scrap value.

Fixed Assets Accounting:

The cost of depreciation can be allocated to several cost centers with the ability to transfer the asset from one location to another within your organization and determine which cost center will bear the depreciation of this asset. The program also provides automatic generation of accounting entries when selling an asset and transferring results to specified non-operating revenue accounts. There is also a wide range of reports to identify assets, commitments, investments, and how to deal with this non-operating revenue asset. Non-operating revenues are revenues that are not collected from the sale of products or services but rather from activities (secondary and other essential activities for the company).

Get a free trial

Get a free trial version without hesitation to discover the features and experience of the program.

Applications

A package of applications on smart devices for effective integration for your work.

Advanced features

Enjoy a more professional experience with

exceptional features

Features

More than seventy features carefully studied

for your ease

Systems

Seven comprehensive systems for all

types of businesses

Fixed Assets System

AlAmeen program helps users in processing and managing fixed assets by defining them, entering their values, estimating their productive life, calculating depreciation, and tracking changes in their values while providing comprehensive reports.

Fixed Assets Management:

All these processes are accompanied by effective reports and tools to ensure full control over all your assets. Assets are processed in terms of identification, consumption, and operations performed on the asset through the fixed asset card, sub-asset card, and operation card. This includes additional asset cards, exclusion from asset cards, asset maintenance cards, depreciation notes, and asset disposal notes. The program also includes various reports related to assets such as asset operations reports, fixed assets reports, and depreciation percentages

for total collections by branch.

The program also provides maintenance operations for the asset system, the ability to invest an asset in exchange for a certain quantity of sales, and the ability to link the asset to a specific customer investment contract, tracking sales for the customer according to the mentioned agreement. Additionally, tracking depreciation of fixed assets that are no longer difficult is made possible by generating automatic depreciation for assets with book value not equal to zero

while considering the scrap value.

Fixed Assets Accounting:

The cost of depreciation can be allocated to several cost centers with the ability to transfer the asset from one location to another within your organization and determine which cost center will bear the depreciation of this asset. The program also provides automatic generation of accounting entries when selling an asset and transferring results to specified non-operating revenue accounts. There is also a wide range of reports to identify assets, commitments, investments, and how to deal with this non-operating revenue asset. Non-operating revenues are revenues that are not collected from the sale of products or services but rather from activities (secondary and other essential activities for the company).

Get a free trial

Get a free trial version without hesitation

to discover the features and

experience of the program.